Non-Lucrative visa Spain: Guide NLV Spain 2024

- 📣 Key points for NLV visa Spain

- ❤️ Spanish non-lucrative visa requirements

- ⛔ How to prove that you have enough funds to stay in Spain with the non-lucrative visa in 2024?

- 🌟 Non-lucrative visa 2024 application processing time

- ☎️ How to apply for a non-lucrative visa in Spain?

- ☝️ Who is eligible for a non-lucrative visa in Spain?

- ⛔ How much money will you need to obtain a non-lucrative visa in Spain?

- ⛔ Do I have to pay taxes in Spain if I don't have a lucrative visa?

- 🎧 Can you work remotely in Spain with a non-lucrative visa?

- 📣 How long can you stay in Spain on a non-lucrative visa?

- 🔍 Can you buy property in Spain with the non-lucrative visa?

- 🥇 What is the bank balance required for a non-lucrative resident visa in Spain?

The Spanish Non-lucrative visa, also known as the Spanish passive visa, is a form of visa that allows individuals to remain in Spain without engaging in any gainful activity (job or professional). This visa is primarily intended for non-EU nationals who have the financial capacity to sustain themselves and want to spend an extended period of time in Spain. Here’s a summary of the requirements for this visa:

Key points for NLV visa Spain

Important information for NLV visa holders in Spain, including income criteria for 2024. To apply for this visa, candidates must prove: The minimum monthly income for an individual applicant is €2,400 (400% of IPREM). Additional income is €600 per month (100% of IPREM) for each additional family member.

Benefits of the Visa Prolonged residence: Allows for a longer stay in Spain without the necessity to work. Quality of life: Experience the Spanish lifestyle and culture without the stress of work. Application Process Documentation is required. Valid passport, proof of income, medical insurance, etc.

Application: Submit the application to the appropriate Spanish consulate.

The non-lucrative Visa Spain is the most convenient way to live in the country. However, you must meet certain standards.

What is a non-lucrative visa Spain?

Non-European citizens can obtain a one-of-a-kind residency permit in Spain with this visa. This visa is for persons who want to live in Spain for a long time. Spain will not allow you to work while on this visa. This is the most popular visa for living in Spain. As opposed to the golden visa, there is no requirement to invest in Spanish real estate. However, the applicant must demonstrate that they have sufficient funds to reside in Spain for at least a year without working.

After the first year of residency in Spain, individuals renew their visa every two years. Then they renew it for two more years. After 5 years, anyone who wishes can obtain permanent residence. Following that, anyone who wishes to stay in Spain may apply for a permanent residency permit. Furthermore, this visa allows you to bring family members as long as you have adequate funds to support them.

Spanish non-lucrative visa requirements

To apply for a Non-Lucrative Visa in Spain, you must meet the following qualifying criteria:

- Sufficient Economic: The IPREM adjusts the figure each year to provide funding for their stay in Spain. In 2024, it is €28,800 per person.

- No employment or economic activity: Proof that you don’t work anywhere in the globe.

- Background Check: You must show that you have no criminal history or that you committed a crime a long time ago. This point may be subjective, depending on the consulate. One of our attorneys would need to analyze your situation.

The main requirements for the non-Lucrative visa are as follows:

The primary conditions for the non-lucrative visa are as follows: Applicants must prove that they have enough money to live in Spain. This visa prohibits working in Spain. This is the main rule. The Spanish government does not want to incur more fees for these folks. Applicants must provide proof that they have enough money to live in Spain. This visa prevents working in Spain. This is the main rule. The Spanish government does not wish to incur further expenses for these persons. Aside from the 28,800 euros needed for the primary applicant. If you bring family with you, you must prove 7,200 euros for each of them.

You have to do this verification at each renewal of your non-lucrative visa and adjust to the IPREM of that year.

Do you want to live in Spain?

Our law firm has more than 15 years of experience.

When you include dependents in your visa application, it’s essential for family members to submit all the mentioned documents. They don’t need to submit proof of financial means. Additionally, different family members require specific documents.

- Minor Children: Provide the birth certificate issued by the civil registry.

- Spouse: Include the marriage certificate issued by the civil registry.

- Partner: foreign documents substantiating an unmarried partnership with the applicant.

- If you are adding a partner: submit the certificate of registration. It must show that you are an unmarried couple. Also, submit any other document substantiating an unmarried partnership with the applicant.

- Adult Children: Include documents demonstrating financial dependence. Also, include the adult child’s civil status and proof that they continue to be part of the family unit.

- Parents: Should submit required documents that confirm their financial dependence. They should also confirm their status as part of the family unit.

All bank withdrawals abroad must be in euros or in any currency but converted to euros.

How to prove that you have enough funds to stay in Spain with the non-lucrative visa in 2024?

You can use various documents to prove your financial means while staying in Spain.

Among these documents are:

- Provide bank statements for the last 6-12 months before the application date. The statements should prove your savings. Submit them to the Spanish consulate.

- You must provide proof of other sources of income. This includes investments, rental incomes, dividends, and pensions.

For example, you can combine all these. If you have 15.000€ of savings and receive a pension of 15.000€/year you can apply for this visa.

You need a validation document from your bank to prove the validity of your credit cards. It also proves the value of the property.

The amount of money requested may be in several bank accounts. Bank statements cannot be more than 6 months old. Finally, the main applicant must have the savings in his or her name or on his or her behalf. Persons claiming to be dependents of the main applicant must provide a marriage certificate or a birth certificate. You must apostille the certificate. Then, a Spanish sworn translator must translate it. This proves their relationship to the main applicant.

Documents required to apply for a non-lucrative visa application

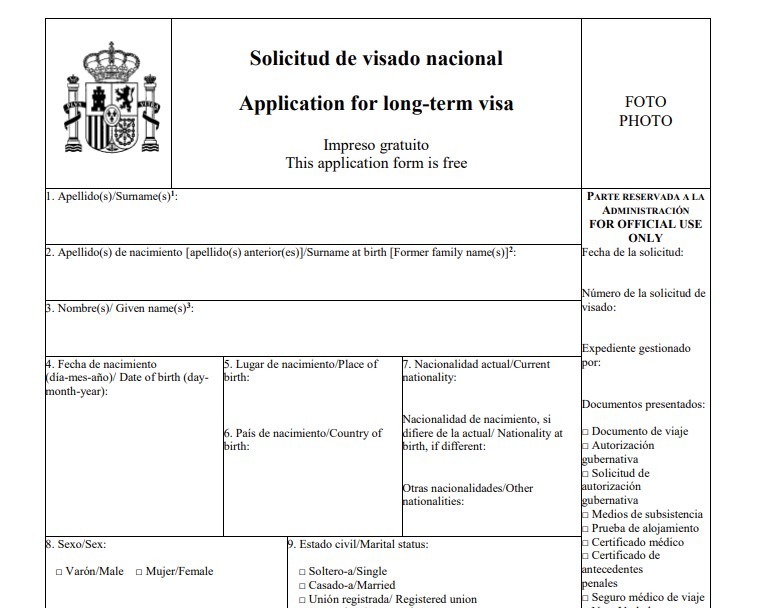

Our lawyers will assist you in obtaining a series of documents required to apply for this visa. They grant the initial visa for one year. You must apply at your local Spanish consulate. The following is a list of the key documents required by the Spanish Consulate for a successful visa application. Non-lucrative visa applications in Spanish Applicants must complete and sign their visa applications. Authorities may reject the application if it contains erroneous or missing information. As a result, the authorities may deny the low-wage residence visa. If a Non-lucrative Visa application is declined, the authorities will notify the applicant in writing.

The communication will explain the reasons behind the decision. To avoid errors, you must be very attentive when filling out the details. Our team of lawyers can assist you throughout the process to avoid issues. Every year, we file more than 500 visa applications. All of them are successful.

Non-lucrative visa application forms in Spanish

Applicants must complete and sign their visa application forms. Authorities may deny the application if it contains incorrect or incomplete details. The authorities could dismiss the non-lucrative residence permit as a result. The authorities will send written notification to applicants if their Non-lucrative Visa is denied. The notification will outline the grounds for the decision. You have to be very careful in the details you are filling in to avoid mistakes. Our team of lawyers can help you in this whole process to avoid problems. Every year we file over 500 visa applications. All them are successful.

Do you want to live in Spain?

Our law firm has more than 15 years of experience.

- Passport photo

Passport photo Applicants for a Spain passive income visa must include a passport photo. You must have a professional take your passport photo with a white background. You cannot submit selfie images. The applicant’s face must be visible, and the photo size should be 3×4 cm. Your Travel Document Visa applicants must provide both the original and a photocopy of the first page of their passport. In addition, you must send the original passport’s biometric data page(s) and a photocopy. Passports must be valid. It must have a minimum validity of one year. The application must be issued within the ten years before its submission. Furthermore, the passport must have at least two blank pages accessible for stamping the Spanish visa.

- Your Travel Document

Visa applicants must have the original and a photocopy of the first page of their passport. Besides, you must submit the original passport’s biometric data page(s) and a photocopy. The passport must be valid. It must have a minimum validity period of 1 year. The application must be issued within the ten years before its submission. Furthermore, the passport must have a minimum of 2 blank pages available for stamping the Spanish visa.

- Police Clearance Certificate

Police Clearance Certificate Applicants must produce an apostilled criminal record certificate. We must also convert it to Spanish. It must be translated by a Spanish government-approved sworn translator. Our legal staff can assist you with this translation. The applicant must provide their criminal record from all countries where they lived for at least 6 months in the previous 5 years.

- Private Health Insurance

Applicants for non-lucrative visas must have private medical insurance. This rule applies to all other Spanish visas. Each candidate must have his or her own insurance policy. Each participant receives their own visa. The Spanish government does not want to incur more expenditures for visa applicants. Private medical insurance must cover all ailments. It cannot include co-payments. Our legal staff is here to help you. They can also connect you with insurance firms approved by the Spanish government. A private Spanish insurance firm must give health insurance for at least one year. There are no additional costs associated with the insurance policy, and you must pay it in full one year in advance.

A private, Spanish insurance company must issue the health insurance for one year or more. You cannot have any extra cost on the insurance policy and you have to pay it one full year in advance.

British citizens can submit the S1 form. We can assist with online registration at the Spanish social security. Instead, purchase private health insurance. We can complete this before the consular appointment.

Applicants must show a completedEx-01 form completed. They must also present a medical certificate indicating good health. The certificate must state that they have no health problems. Spanish citizens may be at danger due to health issues.

When and where to apply for a non-lucrative visa for Spain

You must apply for this visa at least 90 days before you travel to Spain. The Spanish consulate has up to three months to approve your visa. You must submit your visa application to the Spanish embassy or consulate in your place of residency. Before flying to Spain, be sure you have approval. Tourists in Spain cannot apply for this visa.

Interview for your visa

The interview is a necessary requirement for the Spain visa application. For this interview, you must present all of the required documents and forms. During the interview, you must present all visa-related papers. The interviewer conducts the interview, depending on the individual. If they do not trust the applicant, they ask many more questions. They want to confirm the accuracy of the presented information.

Spanish Non-Lucrative visa Cost

Applicants pay the Visa fee on the day of submission at the Spanish Consulate. Applicants must confirm visa fees based on their country of origin. For example, in the UK, the application fee for 2024 is 516£ per person, plus a 9.45£ authorisation fee. In the United States, the application fee costs $152. If you need to know the cost of a non-lucrative visa application from another nation, please contact us and we will inform you without hesitation.

Do you want to live in Spain?

Our law firm has more than 15 years of experience.

Non-lucrative visa 2024 application processing time

The review might take up to three months. If “administrative silence” rejects your application, the process will take longer. When the Spanish Consulate approves the visa, the applicant must enter Spain within three months. The applicant must then go to the police station and apply for the PADRON and TIE card (residency card).

How to apply for a non-lucrative visa in Spain?

You can apply for this visa through one of our lawyers. They will assist you at all times in getting any required documentation. They will make sure it is perfect on the day of the presentation at the Spanish consulate. Our clients leave feedback on Google or Trustpilot. They say the procedure is simple and quick. Check out our MySpainVisa reviews for details.

Get your TIE to finish the residence procedure in Spain. The visa bears the NIE Spain stamp. This number identifies a foreigner seeking to create a bank account or purchase property in Spain. The NIE number is unique to each foreigner and does not expire. After entering Spain with a non-lucrative visa stamped in your passport, our team of lawyers can advise and assist you in applying for a foreigner identification card (TIE). To receive the TIE, you must first register in the place where you plan to live in Spain (PADRON paperwork). within that, you will need to schedule an appointment at a police station to register your fingerprints, and within a few days, you will be able to pick up the TIE card (foreigner identity card).

What are the advantages of residing in Spain with a non-lucrative visa?

Obtaining a non-lucrative visa has numerous advantages:

- It is the quickest route to obtain residency in Spain

- If you hire a lawyer, the process is straightforward.

- It allows you to live in Spain 365 days

- This visa permits for brief journeys to any Schengen State, lasting up to 90 days, without the requirement for additional visa. Schengen has 26 member nations.

- You are not required to invest in the Spanish economy before moving to Spain on a non-lucrative visa

- This visa allows you to obtain permanent residency in Spain if you can live there for 5 years without working

- After staying in Spain for a year, you can get public health care by paying a monthly fee.

What should you avoid during an application visa?

Accurate form filling and legal document acquisition are critical. During the submission process, consulate authorities may ask a series of questions to verify your information. We recommend working with one of our attorneys. They can assist you in completing a simple and inexpensive visa application process. Given our outstanding 99% success rate, it’s an excellent decision.

Frequently Asked Questions

Who is eligible for a non-lucrative visa in Spain?

Anyone is eligible for the Spanish passive visa, but they must demonstrate that they are retired, living on income, or taking a sabbatical year with no labor or economic activity. You must confirm that you earn at least 2400€ per month or have 28,800€ in your bank account. Can I go to Europe with a Spanish non-lucrative visa? Yes, if you have a Spanish passive visa, you can travel in the Schengen zone, but only for 90/180 days, except in Spain, where you can stay for as long as you want because you have a nonlucrative visa. As a non-lucrative visa holder, you can travel to the 25 other Schengen nations.

How much money will you need to obtain a non-lucrative visa in Spain?

It is important to credit at least 28,800€ for the principal; if you are a family, it is 7,200€ per family member, which should provide adequate economic assistance.

Do I have to pay taxes in Spain if I don’t have a lucrative visa?

Previously, spending at least 183 days in Spain was required to renew a non-lucrative visa for the next year. However, following the recent verdict, this minimal stay is no longer required. On March 5, 2024, the Boletín Oficial del Estado (BOE) released a verdict from the Tribunal Supremo that invalidates article 162-2.º-e) of the Real Decreto 557/2011. The clause states that visa holders cannot stay outside of Spain for longer than six months in a calendar year. This means that holders will no longer risk losing their visas if they stay outside of Spain for more than six months within a year, provided that all other requirements are met.

Can you work remotely in Spain with a non-lucrative visa?

Individuals with the non-lucrative visa are not permitted to engage in any professional activity, including remote work, because it does not include a work permit. The visa expressly prohibits any type of employment, remote or otherwise, if you want to work remotely, you need to check the digital nomad visa.

Do you want to live in Spain?

Our law firm has more than 15 years of experience.

How long can you stay in Spain on a non-lucrative visa?

With a D7 visa to Spain, you can stay for one year from the date of admission, but you must begin the process of obtaining your TIE upon arrival in Spain. Because the visa stamped in your passport has an expiration date of 90 days, during this process, you must apply for the TIE, which is a Spanish resident card good for one year. After this initial period, you can apply for renewal for a further period of two years, and thereafter, your visa can be renewed for an additional two years, provided you continue to meet the requirements for this visa.

Can you buy property in Spain with the non-lucrative visa?

Yes, anyone with a Non-working (Non-lucrative) residence visa can purchase property.

What is the bank balance required for a non-lucrative resident visa in Spain?

There is no mandatory balance, as it can include savings, pensions, rents, and dividends. If a retired individual only has €28,800 and no extra cash, they are unlikely to be given the visa because they will be unable to produce sufficient funds for renewal next year, as calculated by multiplying 400% by the yearly IPREM (€28,800). If you have any questions, please contact one of our lawyers.

Why choose us for your Non-Lucrative visa Spain: Guide NLV Spain 2024?

We are a Spanish law firm with more than 15 years of experience. We are specialists in immigration and real estate. We respond in less than 3 hours to all your questions or we schedule a call to resolve all the doubts of the client.

We are experts in obtaining your visa so many clients speak well of us on the internet. If you need help with the visa, contact us!